Mondelez International Inc. (MDLZ) stands as a prominent player in the global consumer goods industry, specializing in the production of snacks, confectionery, and beverages.

This article delves into a detailed analysis of Mondelez International, exploring its stock performance, stock price, stock forecast, and dividend policies.

Mondelez International Inc. Overview

Mondelez International Inc., headquartered in Chicago, is a multinational food conglomerate with a diverse portfolio of well-known brands such as Oreo, Cadbury, Toblerone, and Trident.

With operations spanning across the globe, Mondelez has established itself as a key player in the competitive consumer goods sector.

MDLZ Stock Performance

Understanding the performance of MDLZ stock is crucial for investors seeking to make informed decisions. Historical trends, market conditions, and company-specific factors contribute to the stock’s overall performance.

Investors often analyze factors such as revenue growth, profit margins, and market share to gauge the financial health of the company, influencing the stock’s trajectory.

Mondelez International Inc. is a component of the Nasdaq 100 (US 100).

MDLZ Stock Price

The stock price of Mondelez International Inc. is a dynamic variable influenced by various market forces. Factors like company earnings, economic indicators, and industry trends can cause fluctuations in the stock price.

Investors closely monitor these changes to identify buying or selling opportunities. Analyzing historical stock prices and patterns can provide valuable insights into potential future movements.

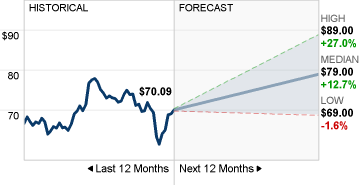

MDLZ Stock Forecast

Investors often rely on stock forecasts to make strategic decisions. Forecasting involves analyzing past performance, current market conditions, and potential future events to predict how a stock may perform.

Various financial analysts and institutions release stock forecasts, providing investors with insights into potential risks and rewards.

It’s important for investors to consider multiple forecasts and conduct their own research for a well-rounded perspective.

Nineteen analysts have provided 12-month price predictions for Mondelez International Inc. Their median target is $79.00, with a high estimate of $89.00 and a low estimate of $69.00. This median estimate suggests a 12.71% increase from the recent closing price of $70.09.

MDLZ Stock Dividend

For income-focused investors, dividends are a crucial aspect of stock analysis. Mondelez International Inc. has a history of distributing dividends, offering shareholders a portion of the company’s profits.

Examining the dividend yield, payout ratio, and dividend history can help investors assess the sustainability and attractiveness of MDLZ as an income-generating investment.

MDLZ Dividend History

- EX-DIVIDEND DATE 09/28/2023

- DIVIDEND YIELD 2.43%

- ANNUAL DIVIDEND $1.70

- P/E RATIO 20.93

| Ex/EFF DATE | TYPE | CASH AMOUNT | DECLARATION DATE | RECORD DATE | PAYMENT DATE |

|---|---|---|---|---|---|

| 09/28/2023 | CASH | $0.425 | 07/27/2023 | 09/29/2023 | 10/13/2023 |

| 06/29/2023 | CASH | $0.385 | 05/17/2023 | 06/30/2023 | 07/14/2023 |

| 03/30/2023 | CASH | $0.385 | 02/01/2023 | 03/31/2023 | 04/14/2023 |

| 12/29/2022 | CASH | $0.385 | 12/09/2022 | 12/30/2022 | 01/13/2023 |

| 09/29/2022 | CASH | $0.385 | 07/26/2022 | 09/30/2022 | 10/14/2022 |

| 06/29/2022 | CASH | $0.35 | 05/18/2022 | 06/30/2022 | 07/14/2022 |

| 03/30/2022 | CASH | $0.35 | 02/03/2022 | 03/31/2022 | 04/14/2022 |

| 12/30/2021 | CASH | $0.35 | 12/10/2021 | 12/31/2021 | 01/14/2022 |

| 09/29/2021 | CASH | $0.35 | 07/27/2021 | 09/30/2021 | 10/14/2021 |

| 06/29/2021 | CASH | $0.315 | 05/19/2021 | 06/30/2021 | 07/14/2021 |

| 03/30/2021 | CASH | $0.315 | 02/04/2021 | 03/31/2021 | 04/14/2021 |

| 12/30/2020 | CASH | $0.315 | 12/02/2020 | 12/31/2020 | 01/14/2021 |

| 09/29/2020 | CASH | $0.315 | 07/28/2020 | 09/30/2020 | 10/14/2020 |

| 06/29/2020 | CASH | $0.285 | 05/13/2020 | 06/30/2020 | 07/14/2020 |

| 03/30/2020 | CASH | $0.285 | 02/06/2020 | 03/31/2020 | 04/14/2020 |

| 12/30/2019 | CASH | $0.285 | 12/05/2019 | 12/31/2019 | 01/14/2020 |

Conclusion

In conclusion, Mondelez International Inc. is a significant player in the consumer goods industry, with its stock serving as an intriguing investment option.

By closely examining MDLZ stock performance, stock price, stock forecasts, and dividend policies, investors can make more informed decisions in navigating the dynamic landscape of the stock market.

As with any investment, comprehensive research and a thorough understanding of market conditions are essential for success.