Applied Materials Inc., a key player in the semiconductor industry, has attracted significant attention from investors and industry analysts alike.

This article provides a comprehensive analysis of AMAT stock, delving into its recent performance, stock price trends, forecasts, dividends, and earnings, offering insights into its position in the ever-evolving technology landscape.

Applied Materials Inc. (NASDAQ: AMAT) has been a cornerstone of the semiconductor industry, playing a crucial role in the production of advanced semiconductor chips and other materials required for the modern technology ecosystem.

AMAT Stock Price and Performance

Over the past few years, the stock price of Applied Materials has exhibited remarkable growth, reflecting the company’s strong performance and its integral role in driving technological innovation.

As of the most recent available data, the stock price of AMAT has been demonstrating a robust upward trajectory, reflecting investors’ confidence in the company’s strategic direction and its ability to adapt to the ever-changing demands of the semiconductor market.

Applied Materials is a component of the Nasdaq 100 (US 100).

Applied Materials Inc. – Leading the Technological Revolution

Applied Materials Inc. has solidified its position as a leading provider of equipment, services, and software to the semiconductor industry. With a strong focus on research and development, the company has consistently introduced cutting-edge technologies and solutions that have revolutionized the manufacturing processes for semiconductors, displays, and other related products.

Its continuous investment in innovation has positioned it at the forefront of the semiconductor industry, enabling it to cater to the growing demands of various technological applications.

AMAT Stock Forecast

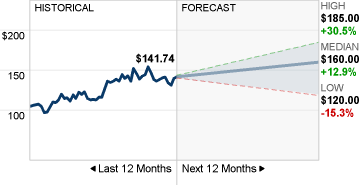

Industry experts and analysts have expressed optimistic views about the future of AMAT stock. The ongoing global digital transformation and the increasing integration of advanced technologies in various sectors are expected to drive the demand for semiconductors, thereby benefiting companies like Applied Materials Inc.

With the growing emphasis on artificial intelligence, 5G technology, and the Internet of Things (IoT), AMAT is anticipated to capitalize on these trends, potentially leading to continued growth in its stock value.

Twenty-eight analysts have provided their 12-month price forecasts for Applied Materials Inc. Their median target stands at 160.00, with the highest estimate at 185.00 and the lowest at 120.00. The median estimate indicates a 12.88% rise from the previous price of 141.74.

AMAT Stock Dividend and Earnings

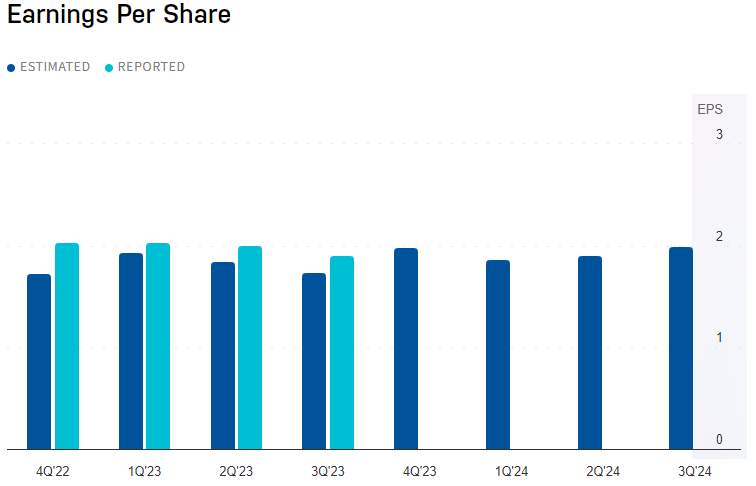

Applied Materials Inc. has a history of providing stable dividends to its investors, underscoring its strong financial performance and commitment to shareholder value.

The company’s consistent earnings growth, coupled with its strategic investments and robust operational efficiency, has contributed to its ability to sustain dividend payments while reinvesting in future growth initiatives.

AMAT Dividend History

- EX-DIVIDEND DATE 08/23/2023

- DIVIDEND YIELD 0.91%

- ANNUAL DIVIDEND $1.28

- P/E RATIO 18.7

| Ex/EFF DATE | TYPE | CASH AMOUNT | DECLARATION DATE | RECORD DATE | PAYMENT DATE |

|---|---|---|---|---|---|

| 11/22/2023 | CASH | $0.32 | 09/07/2023 | 11/24/2023 | 12/14/2023 |

| 08/23/2023 | CASH | $0.32 | 06/08/2023 | 08/24/2023 | 09/14/2023 |

| 05/24/2023 | CASH | $0.32 | 03/10/2023 | 05/25/2023 | 06/15/2023 |

| 02/22/2023 | CASH | $0.26 | 12/12/2022 | 02/23/2023 | 03/16/2023 |

| 11/23/2022 | CASH | $0.26 | 09/08/2022 | 11/25/2022 | 12/15/2022 |

| 08/24/2022 | CASH | $0.26 | 06/09/2022 | 08/25/2022 | 09/15/2022 |

| 05/25/2022 | CASH | $0.26 | 03/10/2022 | 05/26/2022 | 06/16/2022 |

| 02/22/2022 | CASH | $0.24 | 12/02/2021 | 02/23/2022 | 03/16/2022 |

| 11/24/2021 | CASH | $0.24 | 09/02/2021 | 11/26/2021 | 12/16/2021 |

| 08/25/2021 | CASH | $0.24 | 06/10/2021 | 08/26/2021 | 09/16/2021 |

| 05/26/2021 | CASH | $0.24 | 03/11/2021 | 05/27/2021 | 06/17/2021 |

| 02/24/2021 | CASH | $0.22 | 12/03/2020 | 02/25/2021 | 03/18/2021 |

| 11/18/2020 | CASH | $0.22 | 08/31/2020 | 11/19/2020 | 12/10/2020 |

| 08/19/2020 | CASH | $0.22 | 06/11/2020 | 08/20/2020 | 09/10/2020 |

| 05/20/2020 | CASH | $0.22 | 03/12/2020 | 05/21/2020 | 06/11/2020 |

| 02/18/2020 | CASH | $0.21 | 12/05/2019 | 02/19/2020 | 03/11/2020 |

Conclusion

Applied Materials Inc. has established itself as a formidable force within the semiconductor industry, leveraging its technological expertise and innovative solutions to drive the digital transformation across various sectors.

With a promising stock forecast, a history of stable dividends, and a track record of impressive earnings, AMAT remains well-positioned to continue its trajectory of success in the dynamic and competitive technology landscape.