Introduction

He who fails to plan, plans to fail. Trading requires careful planning and deliberation. One must ascertain his or her trading goals or target. how much do you intend to risk per trade and your target profit. What will be your expectation at the end of the week or month base on your plan. Can the strategy you have help actualize this plan?

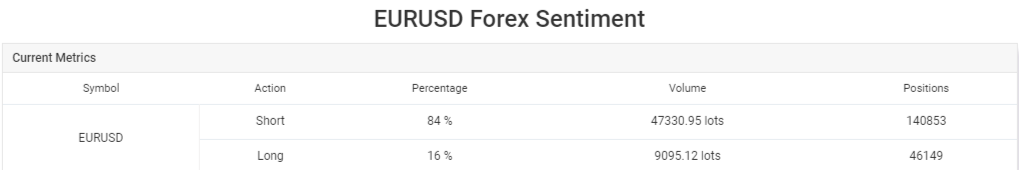

Analysis of EURUSD

Fundamental Analysis

As the socialist New Popular Front leads the exit poll in the French election, the EUR/USD drops below 1.0850.

The EUR/USD pair is down around 1.0830 in the early Asian trading on Monday. According to polls, the French

parliamentary elections ended in a hung parliament, which would be problematic for the Euro. In June, the

United States’ employment growth slowed.

EURUSD Chart Analysis

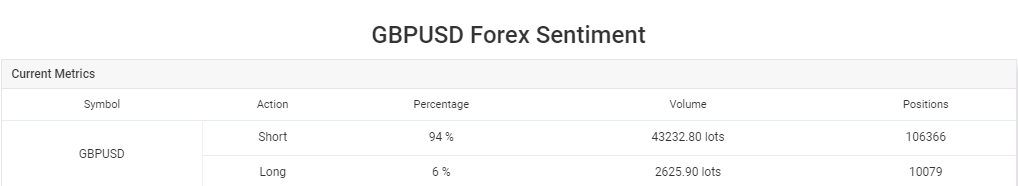

Analysis of GBPUSD

Fundamental Analysis

The US dollar is somewhat stronger, although the GBP/USD pair loses momentum around 1.2800. In the early Asian session on Monday, the GBP/USD exchange is trading down at 1.2805. In June, US nonfarm payrolls exceeded median market estimates. In the UK general election, the Labour Party won a resounding majority, which strengthened the GBP.

GBPUSD Chart Analysis

Analysis of GBPJPY

Fundamental Analysis

GBP/JPY retreats from a multi-year high and falls to the 205.00 region on concerns about intervention. For the second day in a row, sellers are drawn to GBP/JPY, but the fall appears to be restricted. Fears of intervention drive

some short covering in the JPY and put pressure on spot prices. Aggressive bears should exercise care given the

BoJ’s dovish posture and the current risk-on environment.

GBPJPY Chart Analysis

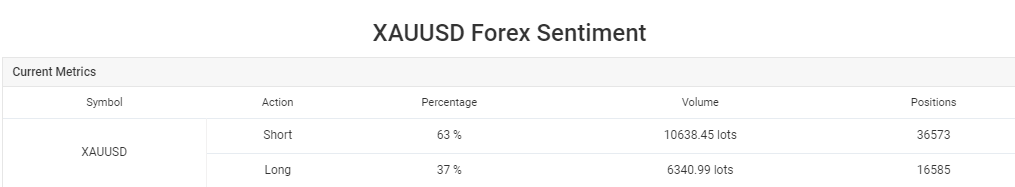

Analysis of XAUUSD

Fundamental Analysis

As the PBoC suspends gold purchases, the price of gold plummets. On Monday, the price of gold begins to decline below the $2,400 mark. Since China’s Central Bank has ceased purchases for the second month in June, yellow metal is trending downward. The negative risk on the XAU/USD could be limited by the anticipation that the Fed will lower the rate in September.

XAUUSD Chart Analysis

Analysis of WTI

Fundamental Analysis

WTI dips below $83.50 as supply is expected to rise and the US NFP is anticipated. The price of WTI is gradually declining, as per the latest data, OPEC raised its output in June. Oil prices are under pressure to decline as a result of possible improvements in the negotiations between Israel and Hamas. It is anticipated that US nonfarm payrolls will expand by 190,000 new jobs, compared to the prior reading of 272,000.

WTI Chart Analysis

Conclusion

Trading is a thing of guessing or gambling. If you do not know it, you can start now or come join us for mentorship: https://my.dbinvesting.com/links/go/955