KLA Corporation, often referred to as KLA or KLAC, is a prominent player in the semiconductor industry. Known for its cutting-edge technology solutions, the company has become a key player in the global market.

In this article, we delve into various aspects of KLA Corporation, ranging from its stock performance to forecasts, dividends, and earnings.

KLA Corporation Overview

KLA Corporation is a leading provider of process control and yield management solutions for the semiconductor and related nanoelectronics industries.

With a focus on helping customers improve their production processes, KLA has established itself as a vital contributor to the advancement of technology.

KLA Corporation is a component of the Nasdaq 100 (US 100).

KLAC Stock Performance

Analyzing the historical performance of KLAC stock provides valuable insights into the company’s stability and growth potential. Investors often consider factors such as stock price trends, market capitalization, and trading volume when evaluating the attractiveness of an investment in KLAC.

KLAC Stock Forecast

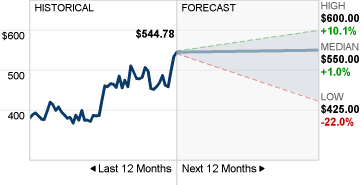

Predicting the future performance of KLAC stock involves a thorough analysis of market trends, industry developments, and the company’s strategic initiatives.

Experts use various forecasting methods, including technical analysis and fundamental analysis, to provide insights into potential stock price movements. A comprehensive examination of these forecasts can assist investors in making informed decisions about their investments in KLA Corporation.

Nineteen analysts have provided 12-month price forecasts for KLA Corp, projecting a median target of 550.00. The range of estimates varies from a high of 600.00 to a low of 425.00. The median forecast indicates a modest increase of +0.96% from the recent closing price of 544.78.

KLAC Stock Dividends

Dividend payments are an essential aspect of evaluating a stock’s attractiveness for income investors.

KLA Corporation’s dividend history, yield, and payout ratio are crucial factors for investors seeking a consistent income stream from their investments.

Understanding the company’s approach to dividends provides a glimpse into its financial health and commitment to shareholder value.

KLAC Dividend History

- EX-DIVIDEND DATE 11/14/2023

- DIVIDEND YIELD 1.06%

- ANNUAL DIVIDEND $5.80

- P/E RATIO 24.42

| Ex/EFF DATE | TYPE | CASH AMOUNT | DECLARATION DATE | RECORD DATE | PAYMENT DATE |

|---|---|---|---|---|---|

| 11/14/2023 | CASH | $1.45 | 11/02/2023 | 11/15/2023 | 12/01/2023 |

| 08/14/2023 | CASH | $1.30 | 08/03/2023 | 08/15/2023 | 09/01/2023 |

| 05/12/2023 | CASH | $1.30 | 05/04/2023 | 05/15/2023 | 06/01/2023 |

| 02/10/2023 | CASH | $1.30 | 02/02/2023 | 02/13/2023 | 03/01/2023 |

| 11/14/2022 | CASH | $1.30 | 11/03/2022 | 11/15/2022 | 12/01/2022 |

| 08/12/2022 | CASH | $1.30 | 08/04/2022 | 08/15/2022 | 09/01/2022 |

| 05/13/2022 | CASH | $1.05 | 05/05/2022 | 05/16/2022 | 06/01/2022 |

| 02/11/2022 | CASH | $1.05 | 02/02/2022 | 02/14/2022 | 03/01/2022 |

| 11/12/2021 | CASH | $1.05 | 11/04/2021 | 11/15/2021 | 12/01/2021 |

| 08/13/2021 | CASH | $1.05 | 08/05/2021 | 08/16/2021 | 09/01/2021 |

| 05/14/2021 | CASH | $0.90 | 05/06/2021 | 05/17/2021 | 06/01/2021 |

| 02/18/2021 | CASH | $0.90 | 02/09/2021 | 02/19/2021 | 03/02/2021 |

| 11/13/2020 | CASH | $0.90 | 11/05/2020 | 11/16/2020 | 12/01/2020 |

| 08/14/2020 | CASH | $0.90 | 08/06/2020 | 08/17/2020 | 09/01/2020 |

| 05/15/2020 | CASH | $0.85 | 05/07/2020 | 05/18/2020 | 06/02/2020 |

| 02/20/2020 | CASH | $0.85 | 02/11/2020 | 02/22/2020 | 03/05/2020 |

KLAC Stock Earnings

Earnings reports play a pivotal role in assessing a company’s financial performance. KLA Corporation’s earnings growth, profit margins, and overall financial health are key indicators for investors.

Examining the factors influencing the company’s earnings, such as product innovation, market demand, and competitive positioning, can offer valuable insights into its long-term viability.

Conclusion

KLA Corporation’s position in the semiconductor industry, coupled with its commitment to innovation, makes it a compelling subject for investors.

By thoroughly examining KLAC stock performance, forecasts, dividends, and earnings, investors can gain a comprehensive understanding of the company’s potential and make informed decisions about their investment portfolios.

As with any investment, it is crucial for investors to conduct their own research and consider their risk tolerance before making investment decisions related to KLA Corporation.