Unveiling the Dynamics of MercadoLibre Inc: A Comprehensive Analysis

Introduction: MercadoLibre Inc. (MELI) has emerged as a key player in the e-commerce and fintech sectors in Latin America.

In this article, we will delve into various aspects of MercadoLibre, ranging from its stock performance and forecasts to notable events such as stock splits, earnings reports, and dividend considerations.

MercadoLibre Inc Overview

MercadoLibre, founded in 1999, has evolved into a diverse e-commerce ecosystem, offering online marketplace services, payment solutions, and digital financial services across multiple countries in Latin America.

Its platform connects buyers and sellers, providing a seamless online shopping experience.

MercadoLibre is a component of the Nasdaq 100 (US 100).

MELI Stock Chart Analysis

Understanding the historical performance of MELI through its stock chart is crucial for investors. Analyzing trends, patterns, and key milestones in the stock’s history can offer insights into the company’s resilience and growth potential.

MELI Stock Forecast

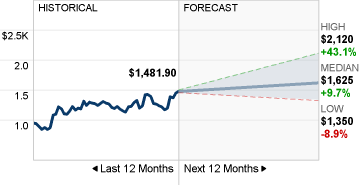

Predicting the future trajectory of MELI’s stock involves considering various factors, such as market trends, economic conditions, and the company’s strategic initiatives.

Investors often turn to financial analysts and forecast models to make informed decisions about the stock’s potential future performance.

Nineteen analysts have provided 12-month price projections for MercadoLibre Inc, revealing a median target of 1,625.00. The range of estimates varies, with a high forecast of 2,120.00 and a low forecast of 1,350.00. The median projection implies a positive growth of +9.66% compared to the recent closing price of 1,481.90.

MELI Stock Split

Stock splits are significant events that can impact investor sentiment and the liquidity of a stock. Examining any historical stock splits by MercadoLibre can shed light on the company’s growth and management’s confidence in its future prospects.

MercadoLibre is presently valued at approximately $1,400 per share, a valuation that suggests it may be a candidate for a stock split based on its current price. A potential scenario could involve a 10-for-1 stock split, allowing the company’s shares to trade at a more accessible price of $140 while maintaining overall market value.

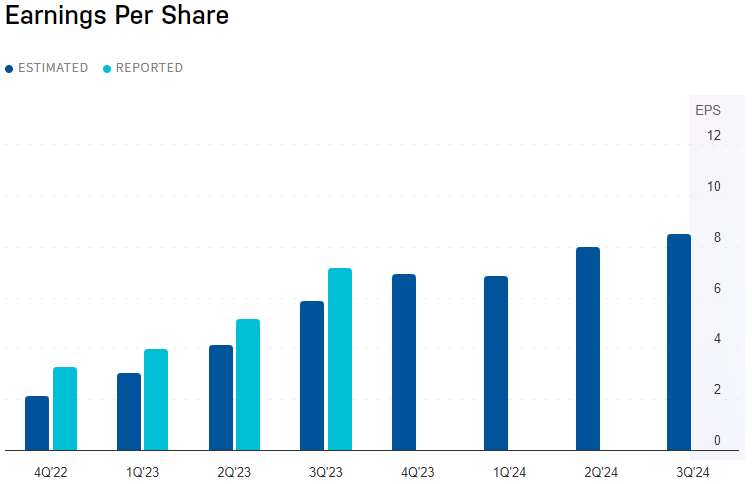

MELI Stock Earnings

Earnings reports provide a snapshot of a company’s financial health. Analyzing MercadoLibre’s quarterly and annual earnings reports can offer valuable insights into its revenue, expenses, and profitability.

Investors closely monitor these reports to gauge the company’s performance and make informed investment decisions.

MELI Stock Dividend

Dividends are a crucial aspect for income-oriented investors. While many tech companies, especially those in the growth phase, may not offer dividends, exploring whether MercadoLibre has initiated any dividend payouts or has plans for them in the future can be significant for investors seeking income from their investments.

MELI Dividend History

- EX-DIVIDEND DATE N/A

- DIVIDEND YIELD N/A

- ANNUAL DIVIDEND N/A

- P/E RATIO 75.84

| Ex/EFF DATE | TYPE | CASH AMOUNT | DECLARATION DATE | RECORD DATE | PAYMENT DATE |

|---|---|---|---|---|---|

| 12/28/2017 | CASH | $0.15 | 11/02/2017 | 12/31/2017 | 01/16/2018 |

| 09/28/2017 | CASH | $0.15 | 08/03/2017 | 09/30/2017 | 10/16/2017 |

| 06/28/2017 | CASH | $0.15 | 05/10/2017 | 06/30/2017 | 07/17/2017 |

| 03/29/2017 | CASH | $0.15 | 03/17/2017 | 03/31/2017 | 04/17/2017 |

| 12/28/2016 | CASH | $0.15 | 11/03/2016 | 12/31/2016 | 01/16/2017 |

| 09/28/2016 | CASH | $0.15 | 08/04/2016 | 09/30/2016 | 10/14/2016 |

| 06/28/2016 | CASH | $0.15 | 05/05/2016 | 06/30/2016 | 07/15/2016 |

| 03/29/2016 | CASH | $0.15 | 03/02/2016 | 03/31/2016 | 04/15/2016 |

| 12/29/2015 | CASH | $0.103 | 11/23/2015 | 12/31/2015 | 01/15/2016 |

| 09/28/2015 | CASH | $0.103 | 09/02/2015 | 09/30/2015 | 10/15/2015 |

| 06/26/2015 | CASH | $0.103 | 05/18/2015 | 06/30/2015 | 07/15/2015 |

| 03/27/2015 | CASH | $0.103 | 03/05/2015 | 03/31/2015 | 04/15/2015 |

| 12/29/2014 | CASH | $0.166 | 11/10/2014 | 12/31/2014 | 01/15/2015 |

| 09/26/2014 | CASH | $0.166 | 08/14/2014 | 09/30/2014 | 10/15/2014 |

| 06/26/2014 | CASH | $0.166 | 05/30/2014 | 06/30/2014 | 07/15/2014 |

| 03/27/2014 | CASH | $0.166 | 03/13/2014 | 03/31/2014 | 04/15/2014 |

| 12/27/2013 | CASH | $0.143 | 11/20/2013 | 12/31/2013 | 01/15/2014 |

| 09/26/2013 | CASH | $0.143 | 08/09/2013 | 09/30/2013 | 10/15/2013 |

Conclusion

MercadoLibre Inc. stands as a prominent player in the Latin American e-commerce and fintech landscape.

By examining its stock chart, forecasts, stock splits, earnings reports, and dividend policies, investors can gain a comprehensive understanding of the company’s past performance and future potential.

As with any investment, conducting thorough research and staying informed about market trends is key to making well-informed decisions regarding MercadoLibre Inc. and its stock.